Get This Report about Pvm Accounting

Get This Report about Pvm Accounting

Blog Article

The Single Strategy To Use For Pvm Accounting

Table of ContentsRumored Buzz on Pvm AccountingThe Buzz on Pvm AccountingWhat Does Pvm Accounting Do?The 9-Minute Rule for Pvm AccountingAbout Pvm AccountingThe Definitive Guide for Pvm Accounting

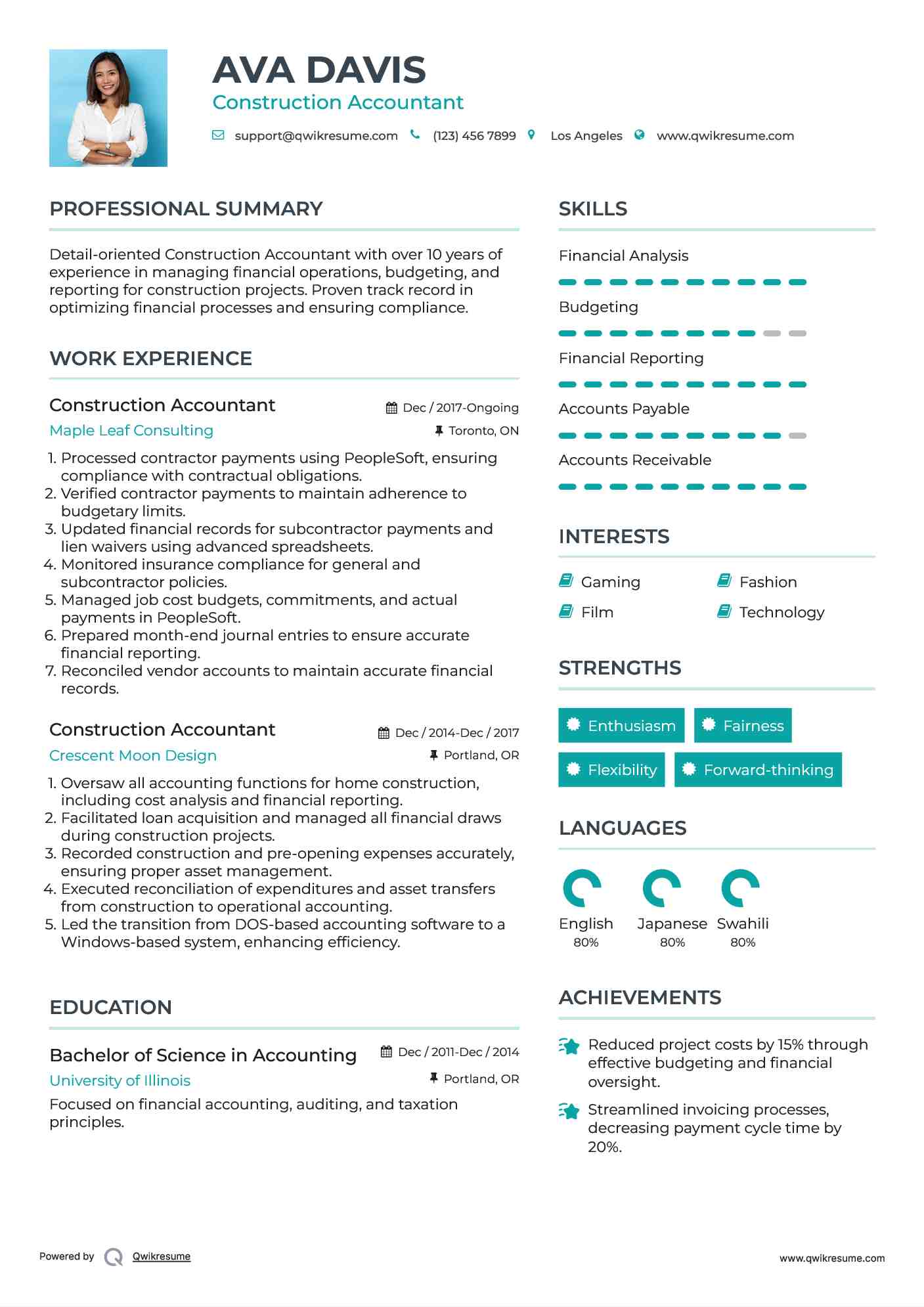

Reporting straight to the CFO, this individual will certainly have complete ownership of the accountancy feature for 3 entities, while handling a group of 3+ people. It features instructor Joann Hillenbrand, CCIFP who presently serves as the Chief Financial Policeman for Airco Mechanical, Included. Joann has even more than 30 years of experience in building bookkeeping and teaches students a range of abilities, including: agreement management accounting cash money management financial statement management construction audit fundamentals building risk administration principles (including insurance) The training course costs $865 to participate in.Rather, firms typically call for levels and experience (i.e. full time work or teaching fellowships). Building and construction accounting professionals look after financials on projects and for their business on the whole. Responsibilities include: planning/coordinating task financials overseeing numerous types of economic evaluation (i.e. project expense price quotes) evaluating economic files (i.e. billings, contracts, and so on) tracking costs and earnings analyzing (and identifying ways to address) financial risks, both on specific projects and those influencing the business overall preparing and sending financial records, both to stakeholders and appropriate regulative bodies To become a building and construction accounting professional, a specific should commonly have a bachelor's degree in an accounting-related field.

The Ultimate Guide To Pvm Accounting

A building and construction accountant prepares financial statements, keeps track of costs and budget plans, and works with project managers and affiliates to make sure that the companys monetary needs are fulfilled. A building and construction accounting professional works as component of the accounting department, which is in charge of producing financial reports and analyses. Building accountants may additionally help with pay-roll, which is a type of audit.

Pvm Accounting - The Facts

Proactively resolving price and functional related issues with job managers, asset managers, and various other inner job stakeholders every day. Partnering with inner job administration teams to guarantee the economic success of the firm's development projects using the Yardi Job Price component, including setting up projects (jobs), budgets, contracts, adjustment orders, order, and processing billings.

Ability to prepare records and service document. Capability to properly present info and respond to concerns from groups of managers and straight and/or service provider employees. Digital Realty brings companies and information with each other by delivering the complete range of information facility, colocation and affiliation solutions. PlatformDIGITAL, the company's worldwide information facility system, supplies clients with a safe and secure information conference location and a tested Pervasive Datacenter Style (PDx) service methodology for powering development and effectively managing Data Gravity difficulties.

The Pvm Accounting Statements

In the very early stages of a building service, the business owner most likely manages the construction accounting. They handle their very own publications, deal with receivables (A/R) and payable (A/P), and supervise pay-roll. As a construction company and checklist of tasks expands, however, making monetary decisions will certainly get to past the duty of a bachelor.

For several months, and even a number of years, Bob does every one of the important audit tasks, many from the taxi of his vehicle. https://www.huntingnet.com/forum/members/pvmaccount1ng.html. He takes care of the capital, gets brand-new lines of credit scores, ferrets out overdue billings, and places all of it into a single Excel spreadsheet - Clean-up bookkeeping. As time takes place, they understand that they hardly have time to take on new projects

Quickly, Sally comes to be look at this site the full time bookkeeper. When balance dues hits six figures, Sally realizes she can not maintain. Stephanie joins the accountancy group as the controller, seeing to it they're able to stay on par with the building and construction jobs in 6 different states Finding out when your construction company is prepared for each role isn't cut-and-dry.

What Does Pvm Accounting Do?

You'll require to determine which role(s) your business needs, relying on financial demands and company breadth. Below's a break down of the typical obligations for every duty in a building company, and just how they can enhance your repayment procedure. Workplace supervisors put on A great deal of hats, particularly in a small or mid-sized building and construction firm.

$1m $5m in annual earnings A controller is typically in fee of the bookkeeping department. A controller might establish up the accounting department (Clean-up bookkeeping).

The building controller supervises of producing precise job-cost accountancy records, taking part in audits and preparing reports for regulators. Furthermore, the controller is in charge of guaranteeing your business abide by economic coverage policies and regulations. They're also needed for budgeting and surveillance annual efficiency in relation to the yearly budget.

Indicators on Pvm Accounting You Should Know

Report this page